In 2020, reader revenue is set to become the main income stream for half of publishers, according to Journalism, Media, and Technology Trends and Predictions 2020, an annual report published by the Reuters Institute for the Study of Journalism, that surveyed 233 CEOs, editors and digital leaders from 32 different countries.

The intensification of reader revenue models like subscriptions, memberships and paywalls is accompanied by the falling prospect of advertising revenue with just one in seven publishers putting their trust in ad money alone.

"Publishers who betted on subscriptions rather than advertising early on now reap the rewards," says the report’s author, senior research associate Nic Newman.

However, "growing competition for a limited pool of people prepared to pay for news is likely to be a challenge this year as subscription models mature," he warns.

"Heavy discounting is already widespread and churn (cancellation) rates are likely to become an increasing worry for those that can’t prove consistent value to audiences."

The future also looks unclear for tabloids that traditionally rely heavily on advertising money, as well as local news outlets with much smaller audiences to tap into.

The survey found a more widespread worry about the decline of local news and public service broadcasters (PBSs) - in Denmark, for example, the public broadcaster DR lost 20 per cent of its funding after the government scrapped the mandatory fee last year.

On top of financial pressures, PBSs are facing growing competition from Netflix and Spotify as well as attacks on their work from populist politicians and commercial media owners.

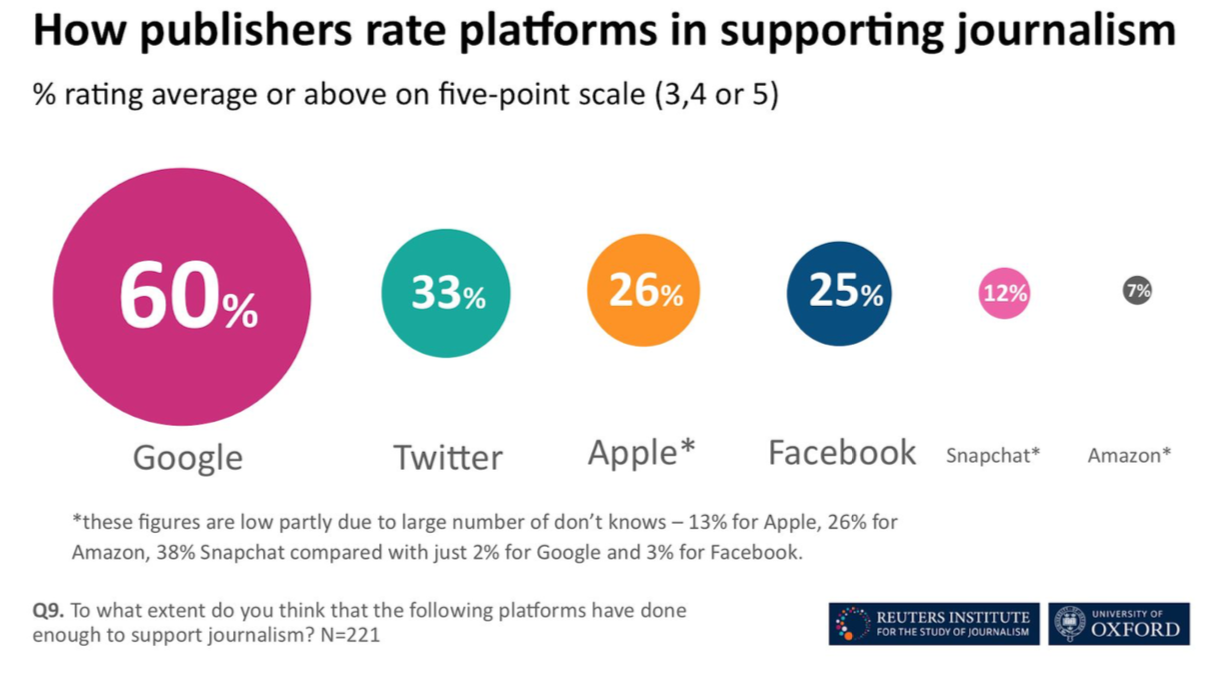

When it comes to big tech platforms, publishers have remarkably varied opinions on whether they have done enough to support journalism.

For example, 60 per cent rated Google highly, while only 25 per cent were appreciative of Facebook’s efforts to support the industry.

However, the report admitted this score may reflect the large number of surveyed publishers who are current or past recipients of Google’s innovation funds (DNI or GNI), and who collaborate with the company on various news-related products. Facebook’s lower score, the report reads, may reflect historic distrust from publishers after a series of changes to product strategy which left some publishers financially exposed.

Overall, there is a sense that newsrooms do not expect hand-outs from platforms, but would rather see a level playing field and get fair compensation for the value their content brings.

Many organisations are also changing their strategies around licensed content, which signals that platforms are on the back foot mainly because of regulations. New products like Facebook News, for instance, distribute large sums of money to few publishers and it remains unclear how this imbalance will impact the wider industry, said Newman.

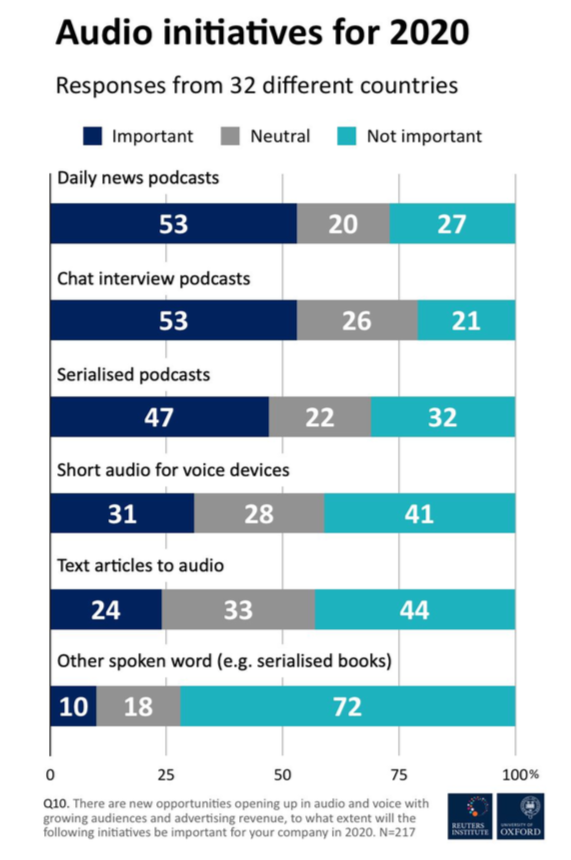

On the plus side, podcasting revenue is projected to grow by around 30 per cent a year to reach over $1bn by 2021 in the US, the report reads. Elsewhere, revenues have been slower to build and, despite the clear audience opportunity, many publishers are still holding back. Others are looking at creating new services for voice devices or turning text articles into audio to capitalise on growing listening amongst the young.

Newman forecasted that new headphones models like AirPods may drive the growth of audio content in the near future. This new generation of headphones offers noise-cancelling and voice-control features that are game-changing for many users.

"They are becoming an operating system of their own, almost like the platforms. This is something to watch for."

Click here for the full report.

Want to receive journalism news and job updates straight to your phone? Subscribe to Journalism.co.uk on Telegram on our jobs channel for latest job opportunities, and our news channel for a weekly digest every Monday morning.

Free daily newsletter

If you like our news and feature articles, you can sign up to receive our free daily (Mon-Fri) email newsletter (mobile friendly).

Related articles

- Six noteworthy initiatives we saw in the media industry this month

- How are news organisations covering the UK's general election 2024?

- NYT's Hannah Yang on subscription ceilings, international markets and news bundles

- Five audience growth and revenue strategies from outside the UK

- RISJ Digital News Report 2024: User needs with Vogue and The Conversation