The final prediction piece this year looks at the fundamental question of financing the media. From public interest news to the B2B sector, almost everyone is grappling with the slowdown of digital subscriptions and rising costs of news production.

When resources are scarce, readers tend to choose quality. Cutting corners will not be a wise strategy in 2023.

Other articles in this series:

- Predictions for journalism in 2023: social platforms and news publishers

- Predictions for journalism in 2023: diversity and mental health

- Predictions for journalism in 2023: AI and tech

- Predictions for journalism in 2023: newsroom leadership, product, and revenue

- Predictions for journalism in 2023: audience expectations and user needs

- Predictions for journalism in 2023: public interest news

Dr François Nel, reader in media innovation and entrepreneurship at UCLan

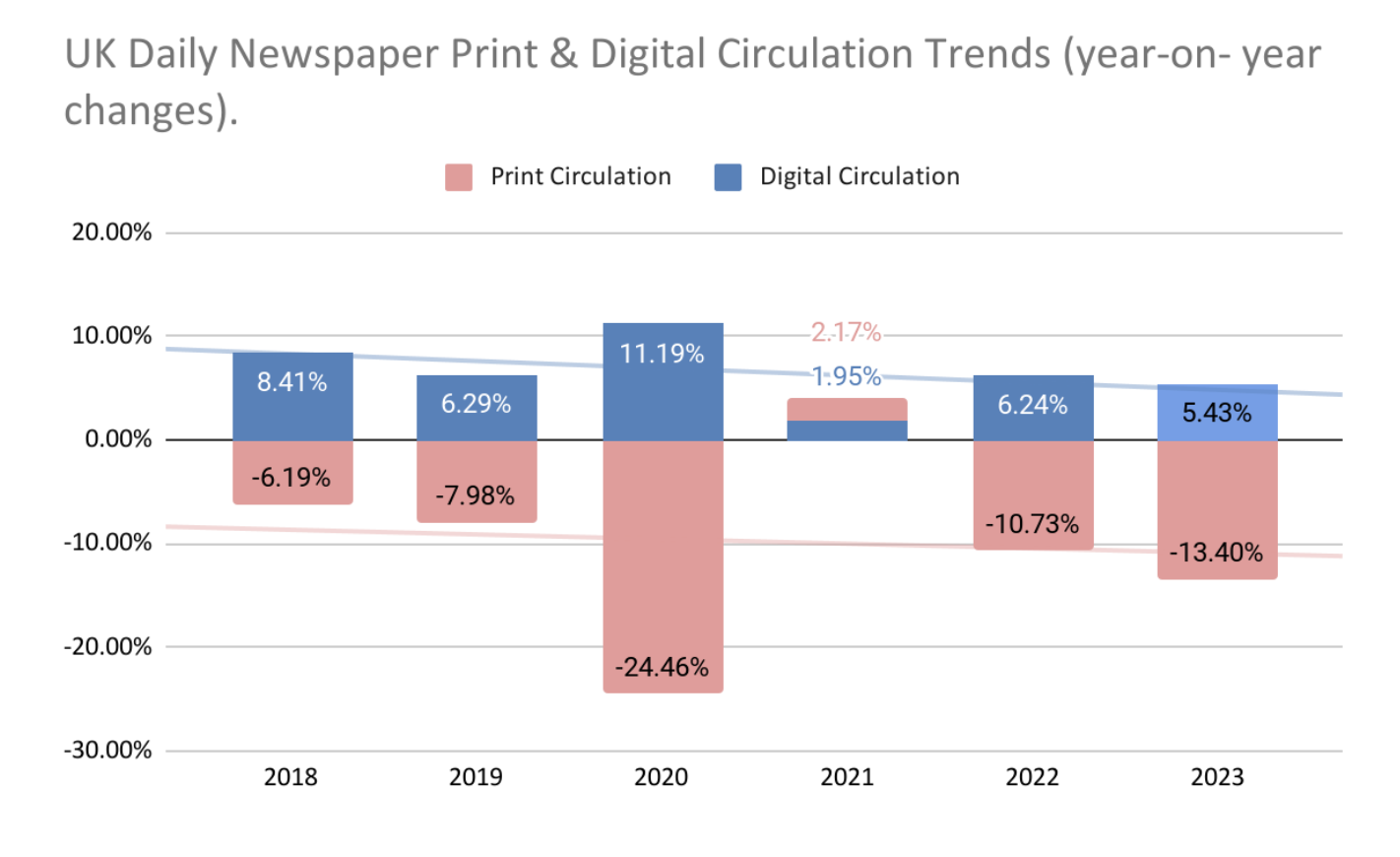

What a tumultuous, newsy year It has been. Even so, UK news publishers have seen paid-for daily print circulations shrink in 2022 and only a comparatively modest rise in digital subscriptions. The expectation is that this long-term trend will continue next year - and even escalate in the years ahead.

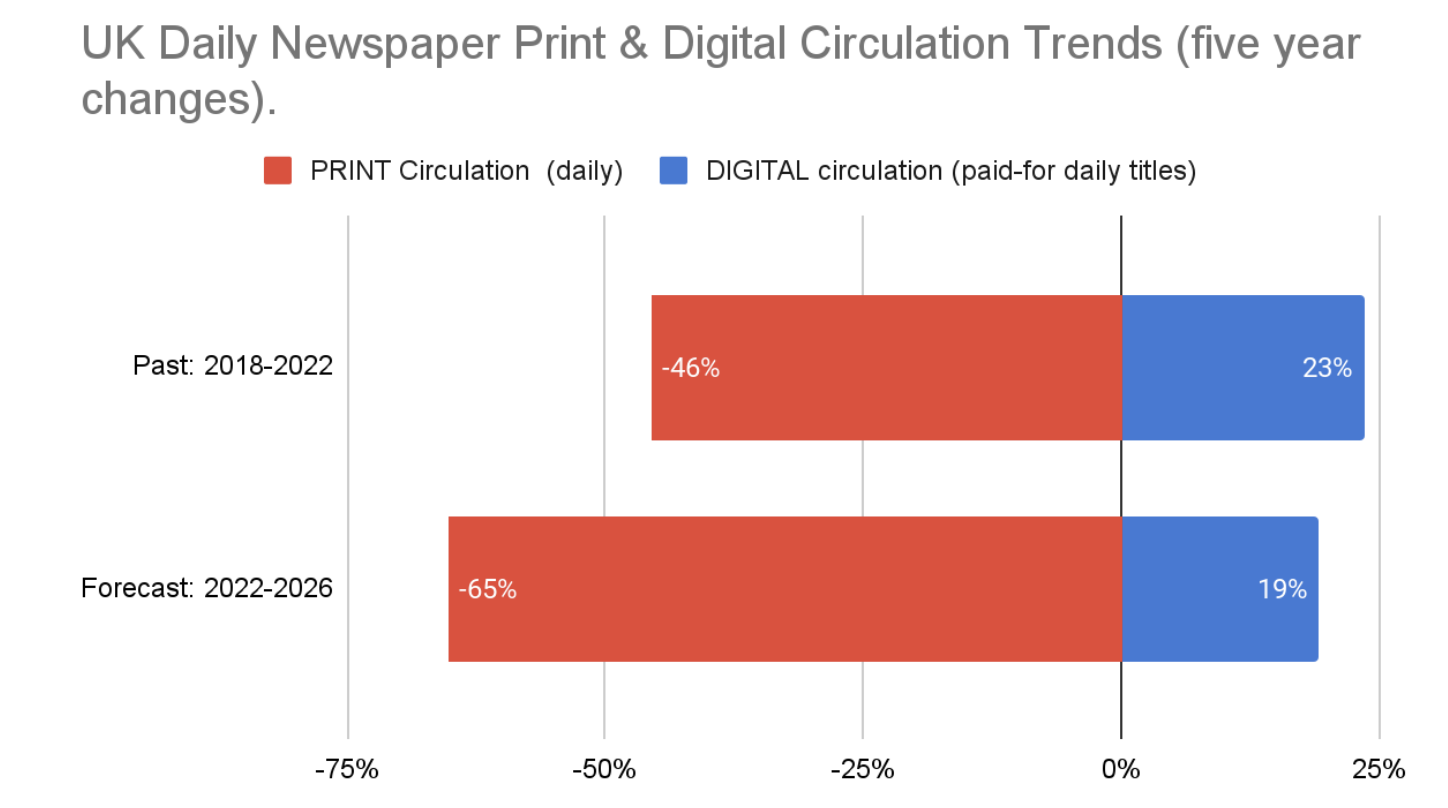

My analysis of PwC data also shows that UK daily print circulations have dropped by 45 per cent in the five years to 2022. That decline is expected to be even steeper in the next five years - a drop of 65 per cent - as news consumers continue to switch to digital, or switch off from mainstream news providers altogether.

Of course, daily newspaper print circulation is only one industry performance metric. Still, at first glance, the situation seems pretty alarming for all those concerned about the future supply and consumption of trustworthy public-interest news in the UK. It need not be so.

I am optimistic that in 2023 stakeholders inside, outside, and alongside the industry will continue to recognise the urgent need to come together to shape shared visions of the future of our industry and to identify key actions required to build the news industry our society needs to thrive.

This much we already know from the News Futures 2035 foresight initiative currently underway: changing the current trajectory will require a concerted effort by public-interest news industry actors, large and small, public and private, to innovate and diversify their current workforces, products and revenue models to ensure increased relevance to the broader public and communities across the nation.

It will also take a concerted effort by policy actors to ensure the policy and regulatory environment is enabling, not constraining. That will only happen if everyone - media industry leaders and policymakers - make a commitment not simply to work harder in 2023, but to work more collaboratively.

Out with the old: Joe McGrath, founder and CEO of Rhotic Media

2023 will signal the beginning of a flight to quality in the world of B2B trade media.

In journalistic circles, quality is highly prized by readers, particularly in the world of capital markets and finance.

And yet, it is something that many B2B financial media outlets are increasingly struggling to deliver. The reason is that quality costs. Many publishers have been struggling with the cost of quality journalism long before the recession hit. In 2023, this problem will come to the fore.

Financial advertisers have become more discerning. Many have moved from renting an audience through traditional PR channels to acquiring their own. They have built content platforms and airlifted many senior journalists from the market.

That is not to say that B2B media does not still have a place in financial institutions’ marketing plans – it absolutely does – but the way that companies spend their budgets has changed.

As the recession starts to bite, media owners need to give financial companies a better reason to use their brands. For those B2B publishers who are still unsure of their value proposition, this will be fatal in the year ahead.

In September 2022, the chairman of the National Association of Press Agencies warned that freelance rates paid by national newspapers were stuck in a time warp. The same is true of B2B media publishers.

Some media owners have become hooked on cheap labour. Now, with inflationary pressures growing and the cost-of-living crisis, journalists (freelance or otherwise) are unable to work for the rates previously offered.

At the same time, financial advertisers increasingly expect companies with whom they spend to reflect their own social values. This means looking after their employees’ well-being. In 2023, they will not look kindly at sweatshops paying minimum wage to churn press releases.

So, as we enter the new year, B2B publishers will need to do a little soul-searching. Those who have already secured their client base by establishing a reputation for quality will ride out the storm, but I fear for those businesses that have not.

Firms yet to determine their strategic position are running out of time to do so. If they leave it too late, it is likely there will be no place for them at all, by 2024.

Free daily newsletter

If you like our news and feature articles, you can sign up to receive our free daily (Mon-Fri) email newsletter (mobile friendly).

Related articles

- Meet the media innovator breaking down barriers between Polish and Ukrainian women

- How The Economist reached young audiences through new formats and brand marketing

- Predictions for journalism 2024: AI and audience revenue

- Newsrewired throwback: What you learned at our previous digital journalism conference

- New platform helps hyperlocal journalists get paid for their stories